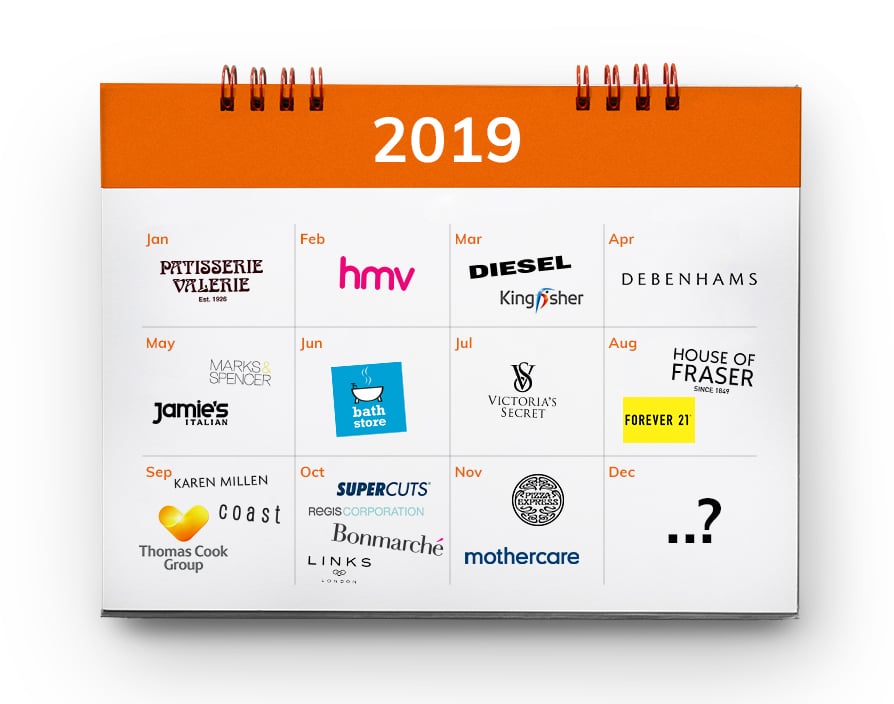

2019 could be remembered as the year that Britain’s big name brands went bust. From Mothercare and BonMarche to Homebase and Karen Millen, Britain’s shopping landscape took a beating this year with the collapse of major retailers leaving thousands of people without jobs, and community highstreets without traditional stores as consumers began to sit up and take notice of bold, creative start-ups.

So, what went wrong?

Many consumers traded scowering the highstreets for purchasing online leaving hundreds of vacant shops up and down the country but this didn’t happen overnight. Sky-high rents and business rates have been increasing for years

and this finally took its toll on the most experienced of retailers. Back in August over 50 major retailers wrote to the Chancellor of the Exchequer, Sajid Javid, asking him to change tax rules in a bid to keep Britain’s high streets alive.

In September, the UK Government promised to plough £100 million into converting and renovating high street buildings across England with the aim of injecting both investment and motivation to ‘reverse the decline of our town centres’ but it appears it has come too late for many at a time when Amazon and Ebay and the like have already accounted for 90% of online marketplace spend this year.

In a press release issued in October, Helen Dickinson OBE, Chief

Executive of the British Retail Consortium, said: “We have seen a persistent downwards trend in retail employment over the past three years, with the Q3 fall of 2.8% equivalent to a loss of 85,000 people across the UK retail industry in the preceding 12 months. Weak consumer demand and Brexit uncertainty continue to put pressure on retailers already focused on delivering the transformation taking place in the industry. While MPs rail against job losses in manufacturing, their response to larger losses in retail has remained muted.”

“The Government should enact policies that enable retailers to invest more in the millions of people who choose to build their careers in retail. In order to promote innovation, training and productivity, Government must reform both the broken business rates system, and the inflexibilities of the apprenticeship levy. This will allow retailers to focus on enhancing their digital and physical offerings for customers, support the development of employees and ensure high streets remain diverse and exciting places for everyone.”

It’s

not all bad news.

A break in the business model of our high street giants has paved the way for start-ups and for those bold enough to create their own modern retail niche in what was previously a market ruled by the retailers most of us have grown up with. Consumers are clearly bored with many of the old shopping habits/methods and products and are relishing the treasures to be found in quirky boutiques and innovative online stores.

Pop-up shops have enabled start-ups to test the water with their products without having to fork out thousands of pounds on rent. This innovative and relatively cheap concept took another twist when major retail players began to follow suit. Amazon launched 10 pop-up shops across the UK and more recently Tesco announced it will open a ‘high-end’ pop-up shop before Christmas that will showcase its ‘finest’ products.

Intentionally planned or not, the concept of both start-ups and established retail brands creating pop-up shops in unison around Britain’s high streets is surely a great idea on numerous levels? Customers get to enjoy a complete variety of products, price points, and brands.

Furthermore, shop landlords with vacancies to fill will be willing to negotiate offers even in prime locations to short-term tenants. Finding long-term tenants is often a struggle for landlords given the current economic climate; they are now willing to sacrifice tenant longevity in exchange for an immediate short-term tenant. The legal obligation between a landlord and a tenant is unique in terms of a short-term lease. A short term lease isn‘t strictly governed by the same legal laws as a standard lease but both need to be equally as thorough. It is important that both parties consider this as many protections as necessary but its likely retailers will save thousands on costs.

Both landlords and

short-term retailers should ensure that that they have the legal standard of liability cover to avoid any unexpected third party damages and financial loss. Legal protections such as liability insurance, business support, professional indemnity and employers’ liability insurance should also be incorporated in order the legal agreement for additional security for both tenant and landlord.

Health and Safety will be no different in a small pop-up shop to a large commercial building. Before opening a pop-up shop health and safety risk assessments should be carried out in order to ensure safety laws are not being breached. One should also produce a health and safety policy to apply to your establishment.

Small businesses accounted for 99.3% of all private sector businesses at the start of 2018 and 99.9% were small or medium-sized (SMEs).

With platforms like nuMONDAY coming onto the scene and growing in strength, much to the delight of thousands of enthusiastic crafters, it will be interesting to see if consumers continue to side with the creatives or the corporates as we move into 2020.

January

French-themed Patisserie

Valerie closes 27 stores resulting in 902 job losses. 122 outlets are still in business.

February

HMV is bought out of administration by Sunrise Records saving 100 stores and 1,487 jobs.

March

Denim fashion brand, Diesel, files for bankruptcy citing mounting losses.

B&Q parent company, Kingfisher, announces closure of 15 stores.

April

Debenhams

goes into administration as lenders take over. The company’s 165 stores continue to trade although 50 are earmarked for closure within three to five years.

May

Marks

& Spencer axe 25 food stores.

Jamie

Oliver’s restaurant chain collapses and 1,000 jobs lost.

June

Bathstore faces administration and 700 jobs are put in jeopardy.

July

Victoria’s

Secret announce a closure of 83 stores: 30 in 2018, and 53 in 2019.

August

House

of Fraser extends its administration for another year.

Rumours begin to circulate that Forever 21 is going bankrupt. In September, the company filed for chapter 11 of bankruptcy to the company’s large amount of debt.

September

Karen

Millen and Coast expect to close over 200 UK stores following a buyout by fashion retailer Boohoo which bought the online business for £18.2 million plans to relaunch Karen Millen and Coast as online stores.

The 175-year old Thomas

Cook goes bust and rumours suggest it could relaunch online following the purchase of the brand name by former shareholder, Fosun.

John

Lewis announces its first

ever half-year loss results.

October

Hairdressing business Supercuts

and Regis go into administration putting 1,200 jobs at risk.

Jeweller, Links of

London plunges into administration.

November

Mothercare – The baby and toddler chain closes 60 shops across the UK putting up to 900 jobs at risk. Last year, total group revenue, including international, was down 13.1% to £295 million. After 58 years of trading, some 2,500 jobs are on the line as the business goes into administration.

BonMarche, the over 50s retailer, go into administration.

Pizza

Express called in the auditors last month after announcing it is over a billion pounds in debt. However, despite the debts the company says 95% of its outlets remain profitable with no imminent closure plans.

December

Following on from Black Friday and Cyber Monday results on consumer spending, it will be interesting to learn how shoppers chose to spend their well-earned cash in the run-up to the Christmas period.

Share via: