Unsurprisingly, our research revealed some common themes. The most common ‘gaps’ are those consistently highlighted by the Institute of Chartered Accountants England & Wales (ICAEW) and HMRC in their AML supervisory reports.

For example, the three most common findings highlighted in the most recent ICAEW supervisory report are:

- Not updating client due diligence on a regular basis

- Carrying out risk assessments on clients

- Not applying a consistent approach to due diligence

Firmcheck’s ‘2024 Landscape Of AML Compliance’ report found that 30% of firms don’t have a standard client risk assessment, and 28% are without a firm-wide risk assessment – one of the most important components of your AML compliance.

The complete juxtaposition of these findings is that of the firms we surveyed, an overwhelming majority (91%) recognised AML compliance as an important part of their firm operations, and 90% of firms said they were confident in their AML compliance measures, despite sharing insights into their processes that documented clear gaps.

Improving your AML compliance

The topsy-turvy nature of these findings is no surprise, though. The Money Laundering Regulations evolved from simply requiring you to get a copy of someone’s ID and store it—job done. Unfortunately, the regulations have been amended over the years to be more robust in the face of financial crime.

Even today though, AML processes are still commonly following that pattern from over 20 years ago, with the most common answers in our research focused on gathering basic information about customers, checking and verifying their IDs, and updating their details/ID documents if something expires – very little attention is given to the due diligence and risk assessment components, which is the most critical part of your AML process.

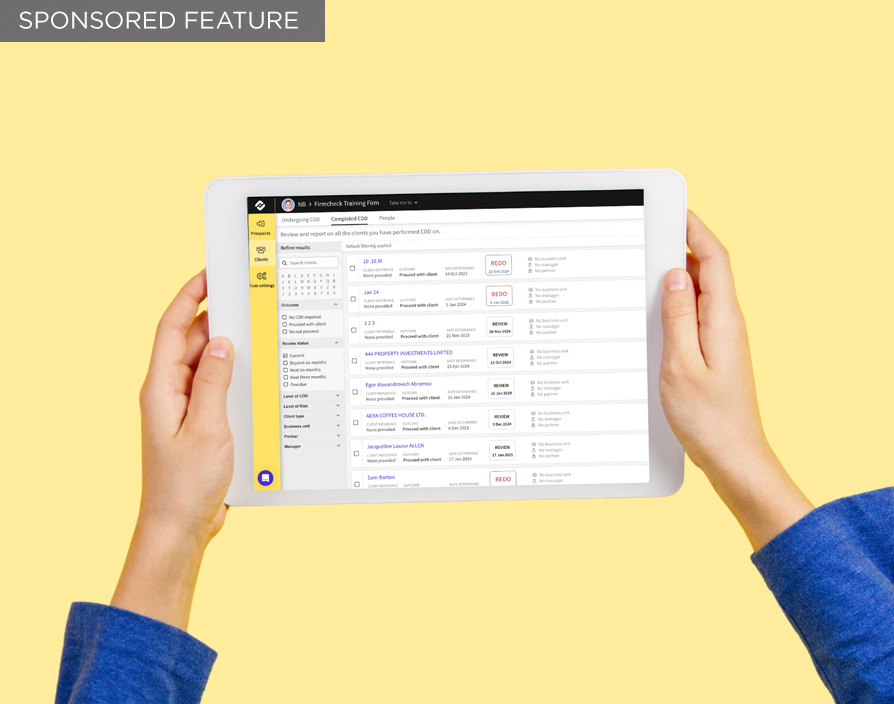

Leveraging software was one way we saw firms closing those common compliance gaps:

Adopting AML compliance software meant firms are 2x more likely to have a standardised means of conducting due diligence, and managing risk assessments

Ongoing monitoring and AML management is 3.2x more likely to happen when using software to manage AML processes.

The other observation we’ve noted during our conversations with accountants and bookkeepers is that they are sometimes unaware, or find making sense of legislation and their professional supervisory bodies guidance challenging.

As a result, actually plugging those gaps or knowing if you’re doing a ‘good enough’ job is hard to establish. That’s why we’ve created a concise, 7-step health check that can give you an indication of how AML compliant you’re in just 45 seconds.

This article come courtesy of AML. You can complete your free AML health check below, and get personalised AML tips if you’d like to make some progress with your current AML processes.

Complete your free AML health check.

Share via: