Access to business finance was a key pillar in supporting smaller businesses through the Covid-19 pandemic and will remain crucial as they shift their focus to recovery, according to the British Business Bank’s Small Business Finance Markets 2020/21 report.

Our annual Small Business Finance Markets report provides a timely and comprehensive review of finance markets for smaller businesses. This year, the report focuses on the impact of Covid-19 on small business finance markets and the implications for 2021, and the use of finance by smaller businesses and market developments in finance products.

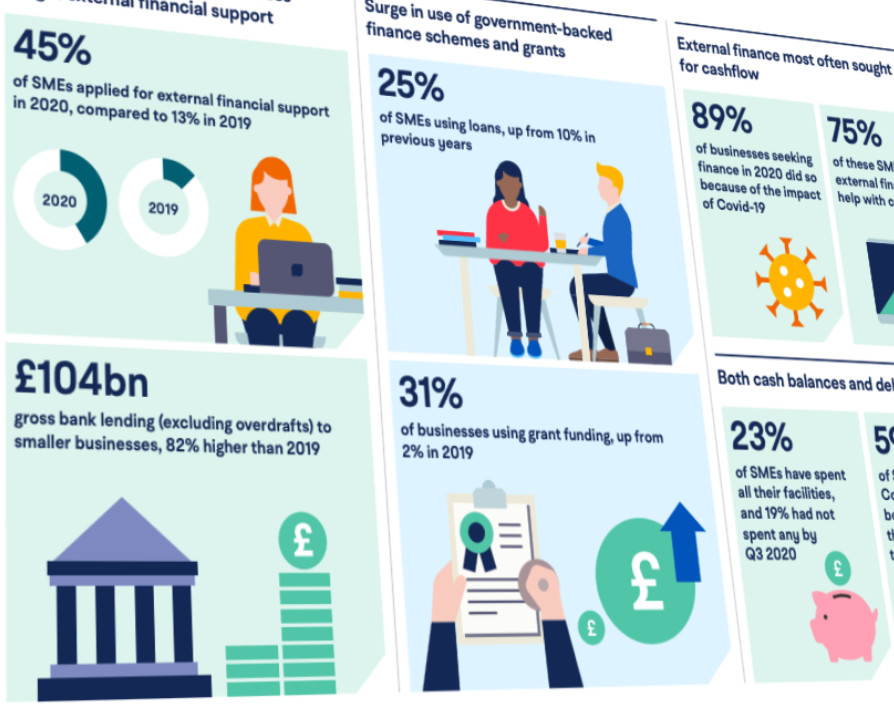

Published in March 2021, four themes provide the background to the seventh edition of this report. First, businesses shifted away from most traditional forms of external finance to utilise government-backed finance schemes and support. Almost half (45%) of SMEs applied for external finance in 2020 compared to 13% in 2019. Unsurprisingly, Covid-19 was behind the surge in demand for financial support, with almost nine in ten businesses who sought finance in 2020 (89%) listing it as the reason for applying for finance.

Our report showed that gross bank lending to smaller businesses in the UK rose to £104 billion in 2020, an 82% rise on 2019 lending data and driven largely by demand for government support loan schemes.

We also found that many businesses shifted away from using traditional forms of external finance to make use of the support schemes available. The use of bank overdrafts, credit cards and asset finance all fell, while the only increase in the usage of traditional repayable external finance was seen in bank loans, up from around 10% in previous years to 25% in 2020.

This is also reflected in Bounce Back Loan Scheme and Coronavirus Business Interruption Loan Scheme lending data, which showed around 1.5m facilities approved by the end of 2020. The use of government grant funding by businesses also increased significantly, from 2% in 2019, to 31% in 2020.

Second, the report found that, due to record cash balances and increasing debt levels, there are both a sizeable number of smaller businesses in a position to borrow further in 2021 and a sizeable number likely to struggle with debt repayments.

Across the majority of industries, we saw between 20% and 30% of SME populations take up a loan during the pandemic, and our data shows that across both BBLS and CBILS, more than half (59%) of SMEs accessing government-backed finance schemes borrowed more than 20% of their reported turnover.

Following a turbulent year, turnover figures declined three times their respective five-year average, with the smallest SMEs experiencing the largest declines. In Q3 of 2020, nearly half (49%) of zero employee firms reported a fall in turnover over the previous 12 months compared to 38% of businesses with 50-249 employees.

Despite turnover being significantly down, a significant proportion of finance facilities taken out because of Covid-19 remained unspent by Q3 2020. In fact, only 22% of SMEs had spent all their facilities and 23% reported they had not spent any.

The government support combined with a continued reduction in operating expenses and precautionary saving led to a 20% rise in deposit holdings since the start of the year to a record £252 billion according to UK Finance data.

Third, smaller businesses have faced a lot of uncertainty in 2020 – and a large proportion of businesses have sought finance due to the impact of Covid-19, most often to help with cashflow.

Nine in ten (89%) businesses seeking external financial support in the past year did so because of the impact of Covid-19, with 75% of these SMEs stating the support was to help with cashflow. Encouragingly 8% said they sought finance, at least in part, to pivot or change their business model and 7% to invest in the digital capability of their business. Seeing smaller businesses quickly adapt the services and products they provide to stay relevant throughout these challenging times has been inspirational, and we. we hope that more businesses will remain optimistic and driven to continue to show agility to meet new requirements.

Finally, as businesses continue to recover from the effects of the pandemic, there could be significant further demand for funding in 2021.

Our report also showed that, in Q4 of 2020, more than a third, (37%) of smaller businesses expected to stay the same size over the next 12 months, 33% said they expected to shrink, but one in five (21%) were expecting to grow.

Small (10-49 employees) and medium (50-249 employees) sized businesses were most likely to expect to grow (35% and 38% respectively). SMEs in business services (25%) and production (23%) sectors were most optimistic about their prospects for growth over the next year, with businesses in construction and other services sectors least optimistic (both 17%).

External finance can empower businesses to invest in changes that will reduce their environmental impact. It can also fuel the innovating smaller businesses that develop new technologies, including green solutions, for others to adopt.

In addition to capacity held by private sector providers, the British Business Bank also has programmes that can meet demand for finance from smaller businesses, and to help the UK build back better. The Bank’s Start Up Loans programme saw successful applicants reaching a peak in June 2020, and a record £126m of funding drawn down in 2020, the highest since the scheme began and up 41% from 2019.

The Bank also has a range of products aimed at supporting venture and growth capital, vitally important to high-growth firms which have the potential to provide jobs and economic growth. British Patient Capital, aimed at this area of the market, has capacity to deploy an additional £1.5bn to support investment in these types of businesses.

Working with government, the Bank has also developed the Recovery Loan Scheme to ensure businesses of any size can continue to access loans and other kinds of finance up to £10 million per business once the existing Covid-19 loan schemes close, providing support as businesses recover and grow following the disruption of the pandemic and the end of the transition period.

There is no denying that this has been an especially challenging period for smaller businesses. However, we must focus our efforts now on the sustainable building back of the UK economy.

Now, as the economy moves to recovery, we must ensure smaller businesses can refocus on new challenges such as transitioning to a net zero economy, levelling up the UK and adapting to life outside the EU. We will continue to support smaller businesses on this journey and remain optimistic about the opportunities that lie ahead for SMEs across all sectors.

“

Share via: