There’s a temptation in responding to the COVID-19 events as organisations and economies seek to recover, that the sole focus is the financial imperative. That may well ignore the other disturbances that society will continue to face and may lead to narrow responses to broader issues that are connected to an organisation’s financial performance.

As a society, we are now expecting our businesses to be more ethical in their approach. We can no longer afford to ignore issues such as climate and resource constraints. Not only are our employees increasingly demanding this more ethical and purpose-driven approach, but so too are our customers and our investors. The finance community within an organisation is not immune to these trends. Rather, it needs to play its role at the centre of them. Performance and insight are domains that we rightly occupy. The culture of organisations is changing. Customer-centricity requires agility, which in turn demands cross-organisational collaboration; here, the finance community is best placed to gain a central position.

Much of finance activity has focused traditionally on reporting the historic: perhaps inappropriately backward-looking in this economic environment. Finance teams need to deliver new insights in more relevant ways in order to address business needs. In fact, a failure to do so threatens to marginalise the finance function and allows shadow organisations and other groups to exploit the demand for this new approach. Much attention has focused on the finance business partner: individuals, or a group of individuals, who are considered the conduit between finance and its stakeholders.

However, what role do they play and how should they respond to this changing dynamic?

Achanging role for the finance professional

ACCA and PwC jointly conducted a survey, a workshop, and several interviews with leading finance professionals to explore current perceptions of the roles and the extent of the opportunities. The opportunities open to accountancy and finance professionals were reflected in six hypotheses that suggested a future direction of travel for this community and the insights that it provides. This has been highlighted through the contribution that these individuals have played in the context of the current business turbulence. Having the agility to support and influence business decision-making in rapidly changing times, supported by access to robust data sources that give an organisation wide insight. The important skills of adaptability and trust come to the fore in situations such as this. Technology and data on their own are never the complete answer. Our survey showed that while most of the respondents claimed that finance business partnering was a proactive role in their organisations, only 37% reported that it was truly embedded: a fundamental part of decision-making and strategy. The two most valued aspects in the role were the support of business strategy and the analysis of current performance; this suggests that finance professionals might not yet be achieving the forward-looking view on which the future of the finance function may depend.

Finance business partnering in small and medium-sized enterprises

While larger organisations tend to have formalised teams and resources devoted to business partnering, it is nonetheless important for the small and medium-sized enterprises (SME) as well. This is reflected in the broad consistency of survey responses between those who identified themselves as working for larger organisations and those who defined their organisation as an SME.

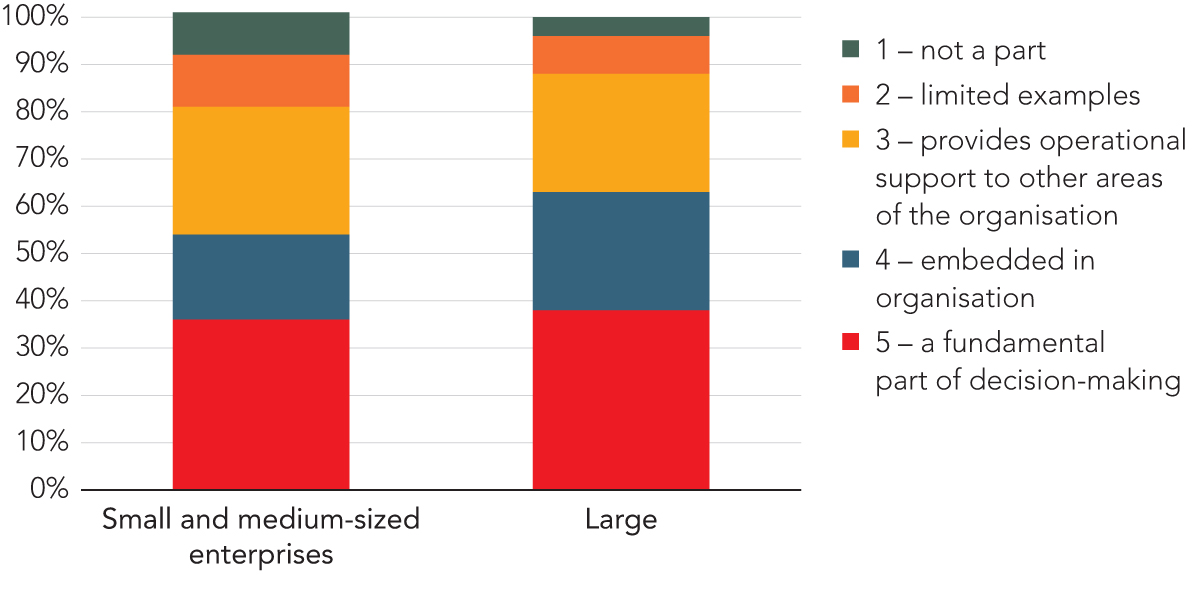

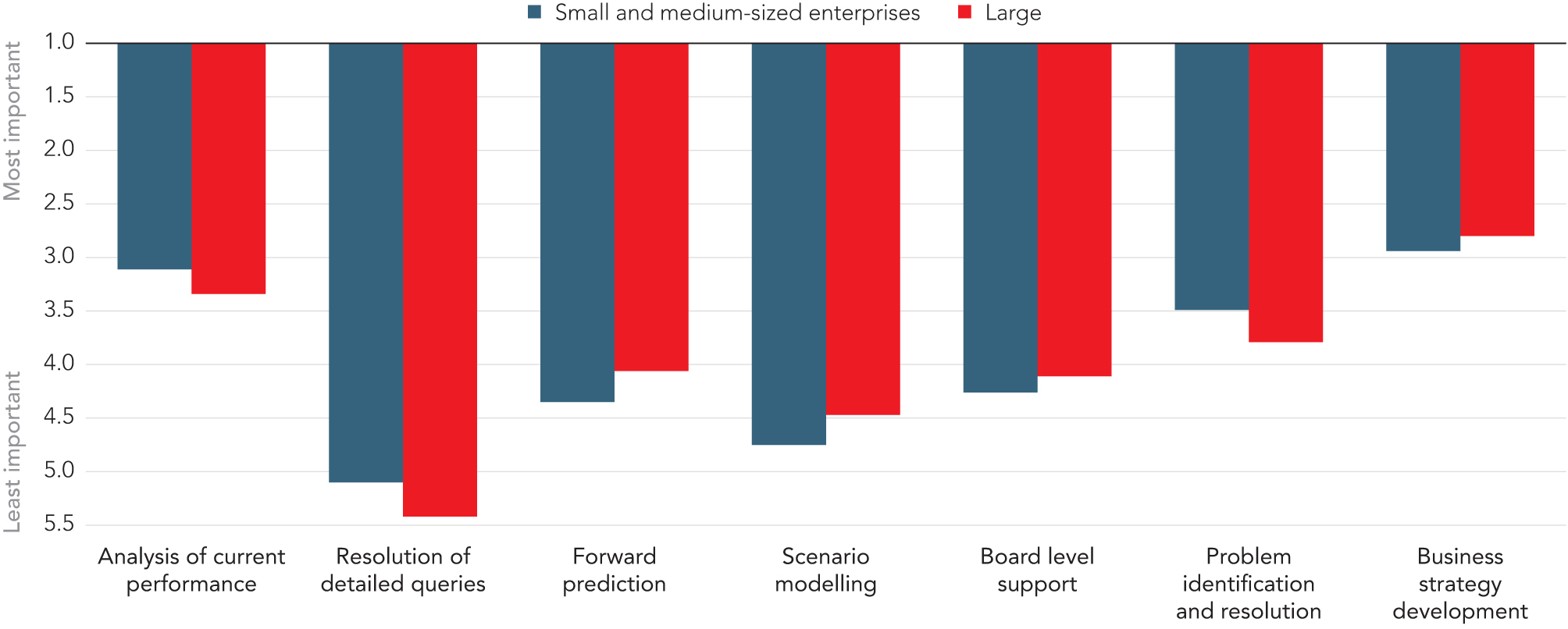

Figure 2.24 compares the two groups to show the extent to which finance business partnering is a core part of each size of organisation. While it has a greater level of importance for the larger entities, in the SMEs over half indicated that it was either embedded or fundamental (54% compared with 63% for larger entities). The attributes of the business partner in the smaller organisations were also broadly similar (Figure 2.25), with the business strategy and the analysis of current performance being the strongest factors for both groups.

The challenge for SMEs is to invest enough in both the data and the people skills needed to achieve the level of analysis and interaction required. The advent of more scalable software applications using cloud technologies, however, means that data is more accessible for this group than before. This can create the opportunity for greater than ever development of these insights. It becomes, therefore, a question of having the right talent, perhaps in combination with those in other roles, to be able to work to generate the strategic insight that is important.

- Recognise that the mindset able to generate insight is equally necessary in SMEs and in larger organisations.

- For medium-sized entities, it is important that partnering and insight is part of the mindset, but they do not necessarily need a formalised structure.

- Develop an approach to insight and analysis that yields results for the SME, accepting that this might involve external parties, such as a specialist practitioner. This is especially true for smaller enterprises.

- Use technology and available data to develop a business model that supports business activities, while accepting that the concept of the ‘digital core’ of the organisation can involve using cloud-based applications relevant to this sector.

“

Share via: