I don’t think anyone in the small business community or beyond though there was going to be a bonanza of giveaways in this Budget, but George Osborne got it just about right in rewarding SMEs for their efforts to support the UK’s economic recovery. Who knows, his legacy might yet be as the ‘Champion of Small Business,’ Chancellor!

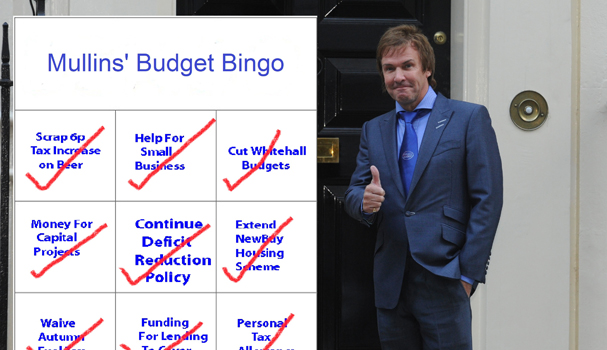

Prior to the Budget, I put together a list of nine ‘action points,’ I wanted to see delivered by the Chancellor in today’s budget and I’m pleased to say he delivered all nine of them. They were:

Scrap 6p increase in beer duty

Help for Small Businesses

Cut Whitehall budgets

Money for Capital Projects

Continue deficit reduction policy

Extend NewBuy housing scheme

Waive Autumn fuel tax increase

Funding for lending to cover extensions

Rise in personal tax allowance

I spoke before the budget of my desire for a, ‘Tradesman’s Budget’ (focused on house-building and home improvements) to kick-start the economy, and I was pleased to see the introduction of the Help to Buy scheme, which will help reinvigorate the housing market and bring work and opportunities to the trades including, builders, and, yes, plumbers amongst others!

The cut in Corporation Tax, the unexpected Employment Allowance and the increase in the personal tax allowance will also serve to support the UK’s small businesses.

In the face of severe opposition I can’t express how pleased I am to see that the Chancellor hasn’t wavered one bit in his determination to cut the deficit, while, at the same time, continue to promote measures to stimulate the economy.

The cutting of corporation tax to 20 percent is a massive boost to all businesses across the country.

It was clear from the start that the Chancellor didn’t have much to play with but by robbing Peter, in the form of cutting budgets of government departments, to pay Paul; in the form of helping British business, he will make a real impact in the operations of small firms.

I applaud the investment in infrastructure, via railways and power stations, something that should have been prioritised during the, ‘good times’ (Gordon Brown, Alistair Darling, I’m looking at you here!).

The Chancellor said this was going to be a budget for an ‘Aspiration Nation.’ Cuts in the fuel tax increase, due to hit the pumps in the Autumn, and the tax relief in the form of a £2,000 exemption on National Insurance for all 450,000 companies in this country, and the increase in the Personal tax Allowance to £10,000 – a year ahead of schedule, creates the right conditions for those who want to get ahead to do just that. ![]()

Share via: