2020 was a tough year for all of us. Businesses and consumers alike were hit by Covid-19 in the spring, struggled to survive through a battered economy throughout the summer, before a resurgent pandemic appeared again in the autumn. Now, as we enter 2021 and yet another ‘lockdown’, it’s maybe worth pondering that many of us have learnt some valuable lessons.

Firstly, when times are tough, we need to make our finances work for us. This is a concept that is understood by consumers, but it’s not necessarily something that SMEs may think about or realise they can change. Even if they do, business owners, managers and directors may be so focussed on the day-to-day running of their business or trying to generate profits that they can struggle to see the wider economic picture. Not only does this require a new way of thinking about business finance from within SMEs themselves, an entire transformation of the global financial system to unlock access to both alternative and traditional finance avenues is absolutely integral.

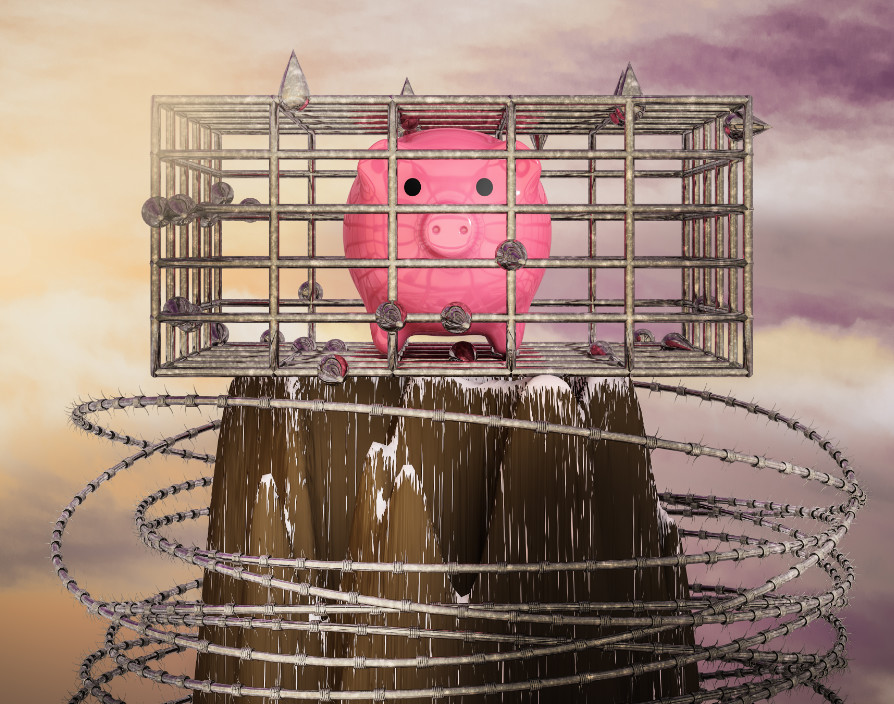

This takes me to my second lesson from the past 12 months. Put simply, the current financial system rewards the haves whilst punishing the have nots. Central banks can create more money on a whim, simultaneously devaluing currencies and slashing the purchasing power of fiat money; for example, the USD has lost more than 85% of its value over the last 50 years. Additionally, banks typically favour funding larger businesses or wealthier customers as there is a perceived lower risk of the loan defaulting and banks may consider these loans to have potentially higher return on investment.

To top it all off, storing funds in a bank doesn’t come without significant risks; we all know that banks loan out more than they hold and we’ve seen in previous banking crises what happens if customers flock to a lender to withdraw their deposits en masse. Witnessing the panic as consumers scrambled to withdraw their savings as Northern Rock collapsed in 2008 was one of the main factors that drove me to create Glint in the first place.

Once you start to realise that the current banking system is unfair, then you begin to critique the entire economic and financial model. With that comes a certain cynicism. Take the recent funding statistics from the Bank Referral Scheme for example; the scheme granted £23m to almost 900 businesses across the UK over 12 months, certainly a vital lifeline for UK businesses and cause for celebration, but I was left with the feeling that the UK’s innovative SMEs had been let down once again by the banks and the government. As usual, the big players had almost unrestricted access to funding whilst SMEs were fighting it out for a few crumbs of credit on offer through alternative finance providers.

The scheme was launched back in 2016 by the HM Treasury and the British Business Bank to provide SMEs with access to finance when they were turned down by their bank. The scheme is much-needed but many of these businesses should never have been denied funding from banks in the first place. As a result, there is a huge, missed opportunity to fund the next generation of growth companies that should be powering the UK’s economic performance. In the current climate, with many of the effects of Covid-19 potentially still to be felt, some companies aren’t fulfilling their potential and may even be forced to close. This SME growth is vital to driving the economic recovery, now more than ever.

Whilst this doesn’t paint a particularly positive picture with which to start 2021, unfortunately, some of the risks I’ve highlighted are just as true in corporate banking as in the commercial side of the industry. Fortunately, more businesses are coming to the realisation that there are alternatives.

Some are looking at moving towards alternatives to traditional currencies in an attempt to regain some control of their finances. Some have identified cryptocurrencies as the way forward, opting to pay employees in crypto or even looking to store company funds in digital currencies such as Bitcoin. This is also something we’ve seen in gold, with increased interest in our corporate accounts and some clients beginning to pay staff salaries in gold.

The reasons behind this shift away from traditional currencies and towards alternatives, whether Crypto or gold, are clear ‘ businesses have had enough of being punished for storing capital in bank accounts offering historically low interest rates. This is a trend that I expect to see accelerate through 2021 and beyond. Businesses have always had to be agile, more so now than ever, and companies of all sizes are now actively searching for a more efficient way of doing business.

Improving access to business finance is a priority for all governments but the challenges UK companies faced last year, and the ones that lie ahead, have made the issue absolutely integral. Without more financial support, UK SMEs will struggle in the months and years ahead. Their loss is our loss; without our most innovative growth companies thriving domestically and abroad, the UK risks losing international competitiveness.

Unfortunately, SMEs can’t rely on the banking system transforming overnight so they’ll have to take full advantage of the entire toolkit of finance options available to them. No doubt, if companies start seeking and securing finance elsewhere, the banks will soon refine their products and approvals’ process to provide a more balanced model that helps rather than hinders SMEs. For too long banks have held all the power; however, I believe this is beginning to change and a full banking and payments revolution has already begun.

“

Share via: